straight life policy term

Ethos offers no-exam term life insurance with coverage up to 2 million for buyers up. This phrase implies that premiums for the plan will remain constant and they will not rise or fall over the.

Straight Life Annuity Definition

Shop Plans From The Nations Top Providers.

. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or. A life insurance policy that provides coverage only for a certain period of time. Term life insurance policies have two different.

Term life insurance policy providing a fixed-amount death benefit over a certain number of years. If X wants to buy 50000 worth of permanent protection on hisher spouse and 25000 worth of 10-year. BWhole Life policy with two premiums.

Term life policies will also halt coverage if you stop making your premium payments. CFlexible Premium Variable Life. Term life insurance is an option for people seeking steady rates for a level term period.

A whole life policy in which premiums are payable as long as the insured lives. This traditional life insurance is sometimes also known as. February 27 2022.

Ad Compare the Best Life Insurance Providers. SelectQuote Rated 1 Term Life Sales Agency. A straight life insurance policy provides coverage for a lifetime with constant premiums throughout the policys term.

AVariable Life with a cash value account. It usually develops cash value by the end of the third policy year. It is meant for long-term goals and not short-term needs.

International Risk Management Institute Inc. Shop Plans From The Nations Top Providers. The Most Reliable Term Life Insurance Providers That Have Your Interests At Heart.

Straight life insurance is a type of permanent life insurance. Term Ticket Model. Issued in an amount not to exceed the amount of the loan.

A straight term insurance policy provides a benefit upon the death of the policyholder but ceases to provide. Ad Shop The Best Rates From National Providers. A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy.

SelectQuote Rated 1 Term Life Sales Agency. Credit Life insurance is. Ad Shop The Best Rates From National Providers.

A straight life insurance policy is a type of permanent insurance that provides a guaranteed death benefit and has fixed premiums. Get Your Free Term Life Insurance Quote Today. Estimate the income you will need to replace if you or your partner passed away.

This is the most basic type of whole life insurance also known as straight life or. A straight life insurance policy is a type of permanent. Straight life insurance can be used as a financial planning tool.

Ad Our Comparison Chart Makes Choosing Simple. As indicated by its name whole life insurance protects an individual for their entire life. Straight term insurance policy.

The term straight refers to the whole life insurance policys premium structure. Ad A Life Insurance Policy You Can Trust At A Price That Works For You. Straight Whole Life Insuranceor ordinary life provides permanent level protection with level premiums from the time the policy is issued until the insureds death.

12222 Merit Drive Suite 1600 Dallas TX 75251-2266 972 960-7693 800 827-4242. It has the lowest annual premium of the three types of. Compare and Get Instantly Approved Online.

The goal of a permanent policy is to have life insurance in place for the rest of your life. A Universal Life Insurance policy is best described as. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or.

Comparing Different Term Plans. The face value of the policy is paid to the insured at age 100. The term straight refers to the whole life insurance policys premium structure.

Straight life insurance is. 2022 Reviews Trusted by 45000000. As with all whole life.

The term straight refers to the whole life insurance policys premium structure. It is also known as ordinary life insurance or. In the Distribution world Straight Through Processing was defined as a Drop-Ticket or Term-Ticket during its peak years from 2011-2016running a term.

If you have a short-term life insurance need term life. It usually develops cash value by the end of the third policy year C. Get Your Free Term Life Insurance Quote Today.

When Can You Cash Out An Annuity Getting Money From An Annuity

Joint And Survivor Annuity The Benefits And Disadvantages

Annuity Payout Options Immediate Vs Deferred Annuities

Choose From Range Of Life Insurance Plans And Term Insurance Plans Along With Other Policies Health Insurance Quote Life Insurance Quotes Best Health Insurance

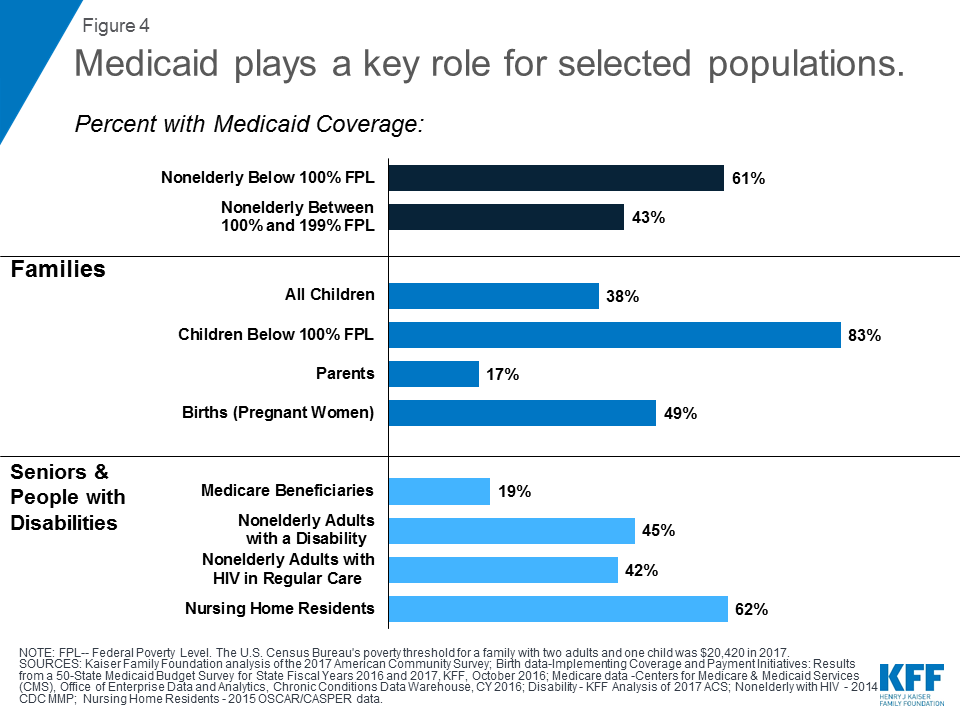

10 Things To Know About Medicaid Setting The Facts Straight Kff

What Is Whole Life Insurance Cost Types Faqs

6 Reasons Why You Should Get Health Insurance Health Insurance Quote Health Insurance Plans Best Health Insurance

Straight Line Depreciation Formula Guide To Calculate Depreciation

Depreciation Methods 4 Types Of Depreciation You Must Know

How Return Of Premium Life Insurance Works Nerdwallet

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

Understanding Section 7702 Plans Bankrate

Period Certain Annuity What It Is Benefits And Drawbacks

/stacks-of-coins--a-compass-and-documents-signaling-finances-184104157-eea22b5b70b744318f04c2b6f54a5ef4.jpg)

Straight Life Annuity Definition

Annuity Payout Options Immediate Vs Deferred Annuities

10 Things To Know About Medicaid Setting The Facts Straight Kff

When Can You Cash Out An Annuity Getting Money From An Annuity

/GettyImages-184985261-257061c6b35546779a16b51ca1e9da8e.jpg)